The Geopolitical Power Play: US vs. China

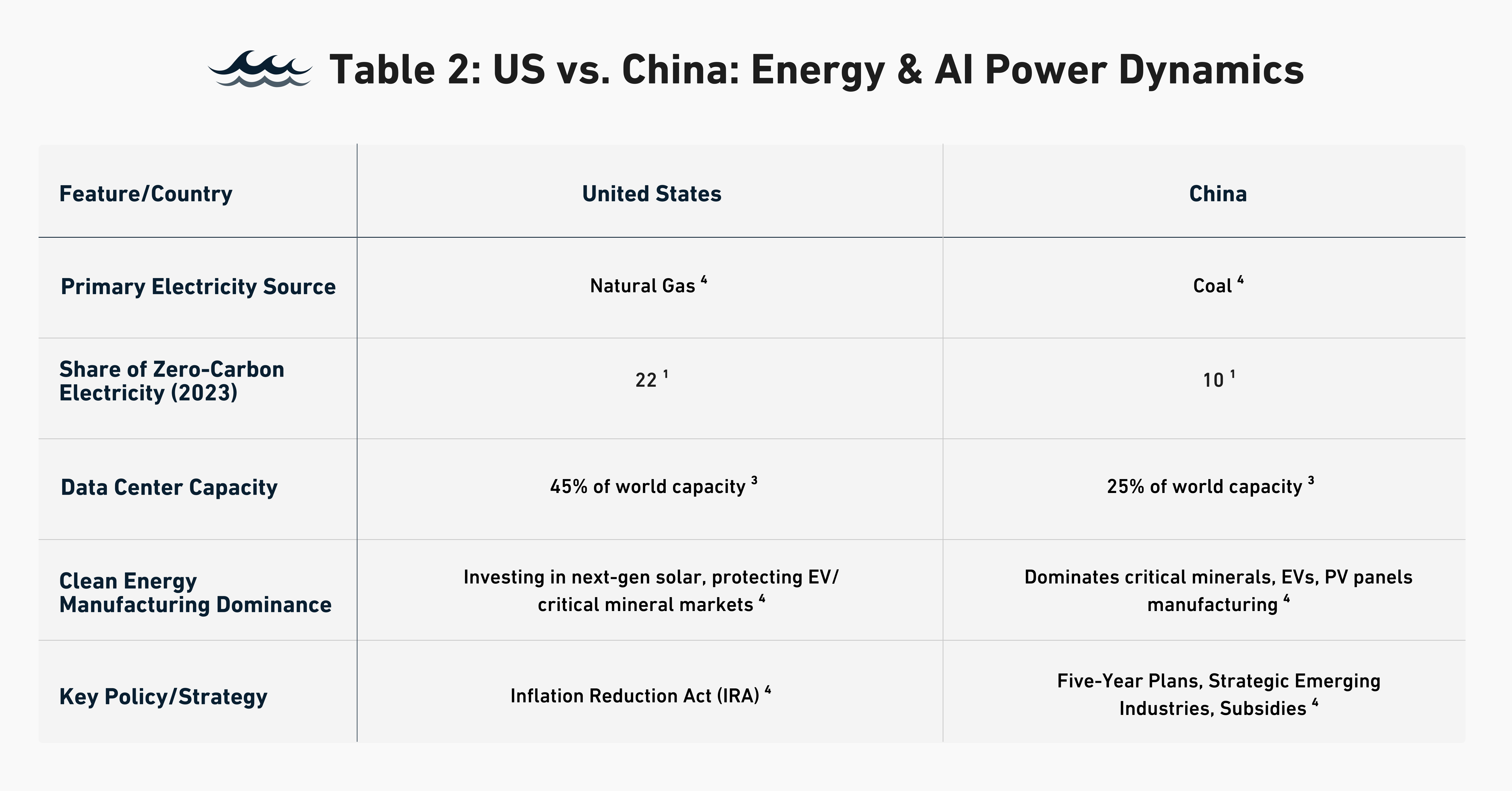

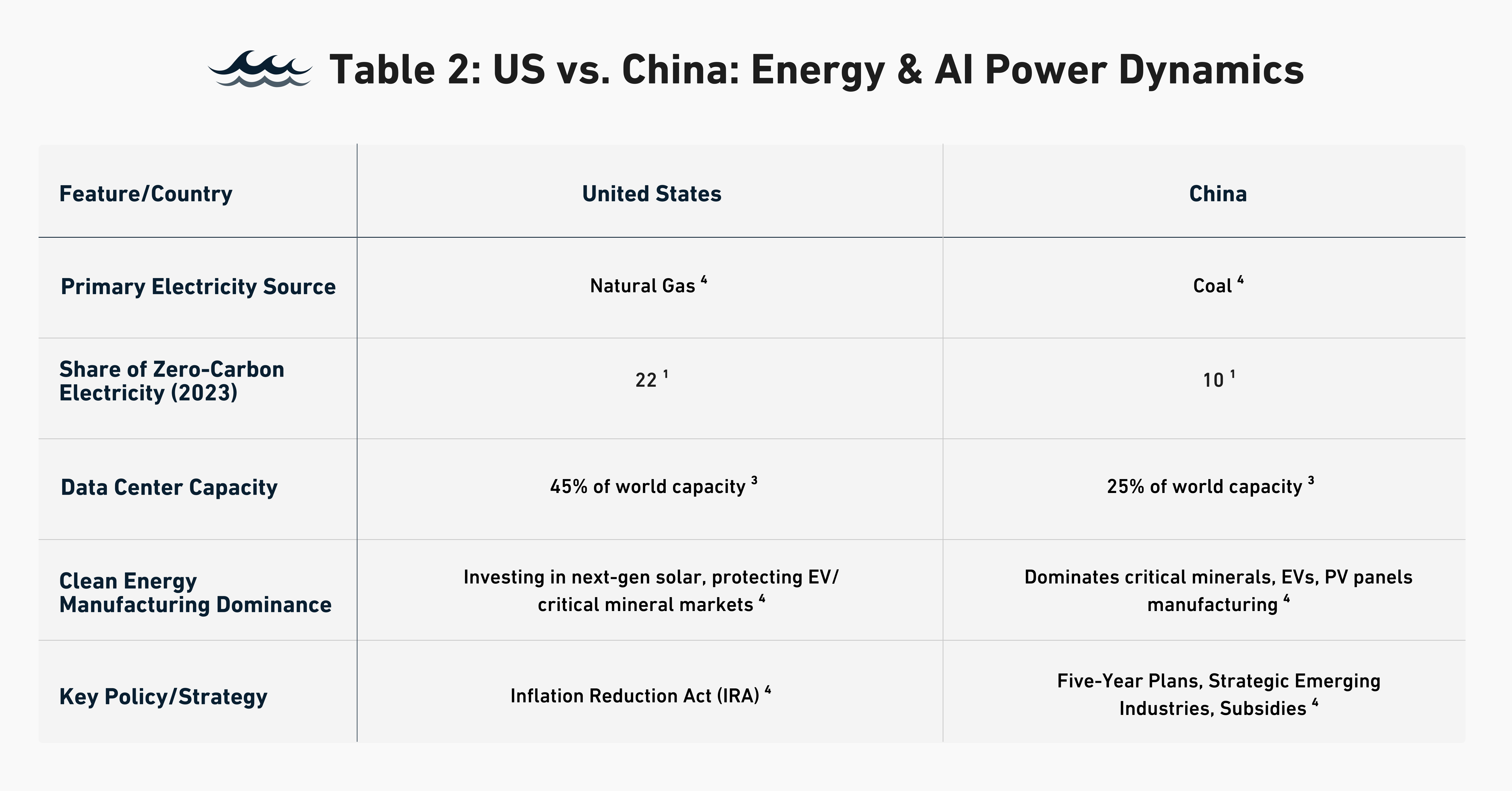

The global race for AI dominance is fundamentally an electricity race, with profound geopolitical implications. The physical infrastructure enabling AI computation, primarily vast networks of data centers, demands immense volumes of electricity to operate.3 The United States and China stand as the undisputed epicenters of this competition, hosting 45% and 25% of the world's data center capacity, respectively.3 This concentration of AI power directly links a nation's technological prowess to its energy infrastructure.

The energy strategies of the United States and China diverge significantly, reflecting their distinct resource bases and economic priorities. The United States relies heavily on domestic fossil fuels, particularly natural gas, for electricity generation. This reliance contributes to lower greenhouse gas (GHG) emissions per unit of electricity compared to China.4 As the world's largest producer of both oil and natural gas, and a significant exporter of liquefied natural gas (LNG), the U.S. benefits from substantial domestic energy resources.4 In contrast, China’s energy supply and electricity generation are predominantly coal-dependent, making it the world's largest coal producer. Despite this massive domestic production, China is a net importer of all forms of fossil fuels, including coal, oil, and natural gas. In 2023, China's economy consumed 81% more energy than the U.S. economy, demonstrating its vast and growing energy needs.4

Beyond traditional energy sources, a fierce competition for clean energy dominance is unfolding. China has made massive, costly investments in the clean energy sector, including critical minerals, electric vehicles (EVs), and photovoltaic (PV) panels. These investments are driven by concerns about energy import security and rapidly growing domestic energy demand.4 China's "Strategic Emerging Industries" initiative, launched in 2010, prioritized new energy and new energy vehicles, among others. In 2023, China was the main driver in the 50% increase in global renewable installations, installing as much solar generation capacity as the rest of the world combined in 2022, and doubling that level in 2023.4

China's dominance extends to critical minerals, where it controls over 80% of the world's manufacturing capacity for PV panels and holds a near-monopsony in the refining of essential minerals like copper, lithium, graphite, cobalt, and rare earth elements.4 This position grants China significant leverage, allowing it to control prices and even impose export restrictions for strategic ends. In the EV sector, China is the world's largest exporter, with EVs constituting 38% of new car sales in China in 2023, often sold at very low prices due to government subsidies.4

The United States has responded to China's aggressive industrial policy with measures like the Inflation Reduction Act (IRA) in 2022, the largest climate legislation in U.S. history. The IRA aims to revitalize U.S. manufacturing and accelerate the energy transition, focusing on domestic content and sourcing from allies.4 While the U.S. faces challenges in competing with China's low-cost PV panel production, it is investing in next-generation solar panel development and protecting its EV and critical mineral markets through tariffs and domestic content requirements.4

The geopolitical implications of this energy competition are profound. China's dominance in clean energy supply chains provides it with considerable geopolitical leverage, enabling it to potentially control prices and flood global markets with cheap exports, thereby undermining nascent industries in other nations.4 In response, the U.S. and European nations are implementing protectionist measures, highlighting the strategic imperative to secure domestic industrial capacity in the clean energy sector. The future of U.S.-China policy will undoubtedly be shaped by this intensifying competition, with the U.S. needing consistent, forward-looking policies to avoid being left behind in the global energy shift.4

The AI race is fundamentally an electricity race and a geopolitical power struggle for energy dominance. The ability to provide stable, affordable, and reliable electricity directly translates into national AI capability and global standing.3 The sheer scale of electricity required by data centers means that a nation's energy policy is not merely an economic consideration but an intrinsic part of its AI strategy and national security. Countries that can consistently provide power without bottlenecks or price surges will be able to scale their AI capabilities faster and more affordably, directly impacting their economic growth, technological innovation, and ultimately, their position as a global superpower.

China's aggressive clean energy manufacturing strategy, while leading to overcapacity, is a deliberate geopolitical maneuver to establish supply chain dominance and economic leverage. By flooding global markets with cheap products, China makes it difficult for other nations to develop their own domestic industries in critical sectors, creating long-term dependency on Chinese supply chains.4 This strategic approach gives China significant geopolitical leverage and control over the future of clean energy, directly impacting the global race for energy production.

Energy independence and diversification, whether through domestic fossil fuels or aggressive renewable development, are essential national security imperatives for both the U.S. and China. This drives their respective energy strategies and shapes global alliances and trade relations.4 The pursuit of secure energy supplies, free from external vulnerabilities, is foundational to national power and influences their geopolitical strategies, trade policies, and even military postures.

The following table offers a concise, comparative snapshot of the two nations' energy and AI postures, visually highlighting their strengths, weaknesses, and strategic focuses, and making the complex geopolitical competition tangible.